Wednesday, February 10, 2010

Another Rise in FHA Default Rates

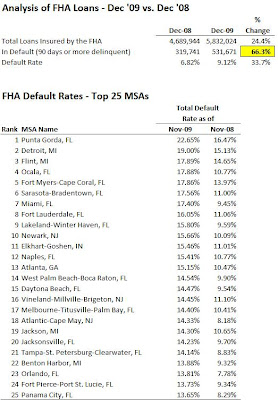

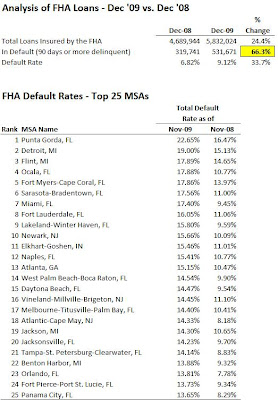

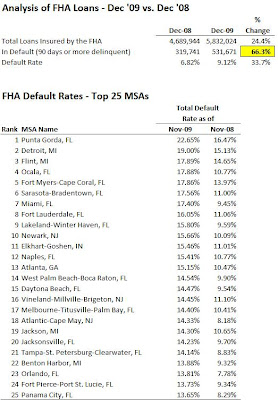

In its latest report to HUD, the Federal Housing Administration disclosed that its default rate (loans more than 90 days delinquent) increased to 9.12% as of December 2009 vs. 6.82% in the prior year. More specifically, 531,671 of the 5.8 million loans insured by the FHA were in default, a staggering 66% year-over-year increase. As expected, Florida led the pack, with the state comprising 16 of top 25 most delinquent MSAs. Michigan had 4 cities in the top 25 and New Jersey had 3. The MSA with the highest default rate was Punta Gorda FL, with nearly 23% of its FHA-insured mortages at least 90 days or more in arrears.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment